Compliance has always been a necessary backlog for regulated industries. It’s that non-negotiable checklist standing between you and operational freedom. But here’s the truth: the traditional way of handling compliance, manual tracking, endless documentation, siloed tools, is broken. It’s inefficient, expensive, and reactive.

Traditionally, firms depend on manual or limited technologies to manage their compliance frameworks.

- Nevertheless, these solutions frequently lack a unified methodology.

- Isolated systems and disjointed communication channels add to operational inefficiencies.

- Departments often encounter challenges due to fragmented reporting systems, ambiguous duties, and redundant procedures that hinder effective oversight.

In the absence of efficient governance, compliance responsibilities become reactive endeavors, resulting in firms remaining in a state of continuous audit failures.

What if compliance didn’t have to be this hard? The task involves not only fulfilling current compliance standards but also ensuring preparedness for future rules and risks. Organizations are increasingly acknowledging the need to transition from fragmented compliance tactics to more robust, automated, and cohesive solutions.

Compliance is No Longer a Checkbox, It’s a Moving Target

From GDPR and HIPAA to SOC 2 and PCI-DSS, the rules evolve faster than most teams can adapt. With the addition of cloud migrations, hybrid infrastructures, and third-party integrations, suddenly compliance becomes a full-time battle.

Most legacy systems weren’t designed for this level of complexity. Manual processes, spreadsheets, and disconnected tools only increase the risk of errors and missed controls.

That’s where automated compliance steps in.

What is Automated or Self-Running Compliance and Governance?

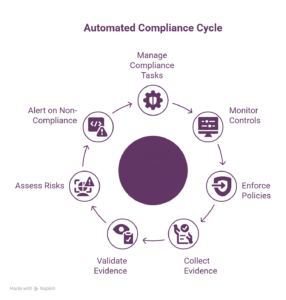

At its core, automated compliance refers to using technology to manage, monitor, and enforce compliance tasks with minimal human intervention. Instead of chasing after logs and policies during audit season, automation ensures that controls are continuously tracked and enforced in real time.

It covers:

- Control mapping across multiple frameworks

- Continuous evidence collection and validation

- Real-time risk assessments

- Automated alerting on non-compliance events

It’s not just automation for the sake of efficiency; it’s strategic automation that brings predictability to something that’s usually chaotic.

Where AI Fits In: The Intelligence Layer

Automation alone isn’t enough. It’s the intelligence built on top that changes the game. This is where AI in compliance becomes the real differentiator.

AI brings capabilities like:

- Predictive risk scoring: Identifying areas where compliance is likely to fail before it happens.

- Natural language processing (NLP): Parsing regulatory documents to map controls automatically.

- Anomaly detection: Spotting unusual behavior that could indicate a breach in policy.

- Smart workflows: Dynamically adjusting compliance checks based on system or business changes.

AI watches over everything, flags problems, updates rules, and keeps your business compliant with the latest regulations, without needing someone to step in constantly.

Instead of managing separate tools or processes, this model brings everything, policy enforcement, risk monitoring, compliance validation, into one seamless system that talks to itself and adapts in real-time.

Key Components of Self-Running Compliance:

- Automated Policy Enforcement: The system ensures your security rules are followed across every app, system, and user without fail.

- Always-On Monitoring: It spots risks or unusual behavior the moment they happen.

- Real-Time Compliance Checks: Instead of waiting for audits or manually checking if you’re meeting regulatory standards, the system keeps you aligned and alert all the time.

- Smart Learning with ML: Using machine learning, it picks up on patterns and helps spot threats before they cause real harm. It also makes decisions faster and smarter as it learns.

Real-World Use Case: Continuous Compliance

Let’s take the example of a fintech startup operating in multi-cloud environments. They handle sensitive customer data, integrate with multiple payment gateways, and are subject to PCI-DSS, SOC 2, and GDPR.

Here’s how automated compliance transformed their process:

- Baseline automation: All security controls were mapped and aligned across compliance frameworks using prebuilt templates.

- Continuous evidence collection: System logs, access control lists, and encryption policies were monitored in real time, no more screenshot uploads.

- AI-driven insights: A predictive engine flagged areas where access control policies might drift, even before violations occurred.

- Audit readiness: With everything centralized, audits went from 4 weeks of scramble to 2 days of data export.

Result? The company saved over 60% of time typically spent on compliance prep while improving their overall security posture.

Challenges You Need to Watch Out For

Like any shift, adopting automated compliance and AI in compliance comes with its own set of challenges:

- Tool sprawl: Integrating too many tools without a strategy leads to more complexity.

- Data quality: AI is only as good as the data it’s trained on. Incomplete logs or inconsistent tagging can throw off your insights.

- Over-reliance: Automation can’t replace human oversight completely. You still need expert review, especially in nuanced compliance decisions.

The key is finding the right balance, using AI and automation to amplify human judgment, not replace it.

Key Features to Look for in an Automated Compliance Platform

Not all platforms are created equal. When evaluating tools, focus on:

- Framework flexibility: Supports multiple compliance standards out of the box.

- Scalable architecture: Designed for hybrid and multi-cloud environments.

- Real-time monitoring: No more manual uploads or quarterly assessments.

- AI-native capabilities: Look for embedded machine learning features, not bolt-on ones.

The best platforms treat compliance as a continuous lifecycle, not a point-in-time project.

Where Are We Headed: Autonomous Compliance?

Today we are talking about automated compliance. But the future? It’s autonomous compliance, systems that can adapt in real time, self-heal policy drifts, and adjust controls dynamically without human prompting.

We are not fully there yet, but AI is accelerating the journey. As regulatory complexity grows and digital ecosystems become more dynamic, AI in compliance will be the foundation of trust and resilience.

Self-Running Governance Leads, Not Follows

Compliance shouldn’t be a blocker; it should be a business enabler. With the right mix of automation and intelligence, organizations can stop playing catch-up and start getting ahead.

The future lies in intelligent, automated systems that don’t just support security, they actively lead it. Self-running governance models are a leap toward resilience, efficiency, and trust at scale.

One such platform enabling this shift is Transilience, an AI-powered governance engine designed to do exactly what today’s businesses need: take charge of policy enforcement, compliance monitoring, and threat response, without human handholding.

We recently showcased how Transilience works, live, during our feature event. From auto-validating compliance across environments to instantly adjusting user access policies in real-time, the platform demonstrated what modern governance should look like.

If you want a closer look at how this actually works in practice, watch the live demo of Transilience in action. If you are curious to know how this can help your business, contact our experts.

Author

-

Richa Arya is the Senior Executive Content Marketer and Writer at Network Intelligence with over 5 years of experience in content writing best practices, content marketing, and SEO strategies. She crafts compelling results-driven narratives that align with business goals and engage audiences while driving traffic and boosting brand visibility. Her expertise lies in blending creativity with data-driven insights to develop content that resonates and converts.

View all posts